Banking & Financial Services

Software/Application Development and Testing Tools to Reduce Risk

Learn How Spira Can Help TodayThe financial services industry has been rocked with unprecedented changes in the 21st Century, with increasing regulation (Sarbanes-Oxley, Dodd-Frank, FATCA) and increasing use of cutting edge technology (high-speed trading, advanced simulations). Because of these significant changes, banking software and mobile application development (and testing) is crucial for keeping up and delivering a quality product to users.

Given the high-stakes nature of handling sensitive information, comprehensive QA practices and testing should be a cornerstone of any financial software. Inflectra has the industry-leading tools to help you develop, test, and manage your software assets, ensuring regulatory adherence and minimizing risk of costly errors. With our deep understanding of the banking and financial services industry, we provide the solutions and expertise necessary to ensure that your software meets the highest standards of quality while keeping development efficient and compliant.

Compliance Challenges

The banking sector has experienced huge shifts in regulations such as Sarbanes-Oxley, Dodd-Frank, and FATCA. On top of this, new cutting edge technologies like high-speed trading and blockchain for cryptocurrencies are challenging existing business models and laws. Inflectra enables your software development to remain compliant from start to finish, without sacrificing efficiency or budget.

Tools You Can Trust

Inflectra has capable tools to help you develop your software applications and core financial systems, maintaining transparency throughout the entire lifecycle. We have proven turnkey solutions that give you powerful traceability and reporting, with customizable workflows and AI automation features that streamline compliance.

"Improving QA and Increasing Productivity"

Oney Bank was managing their QA and project management on a suite of outdated tools. After thorough research, they elected to migrate to Inflectra’s SpiraTest platform to modernize their front office and back office QA systems. Using SpiraTest, Oney Bank is managing requirements, test cases, and defects in customizable and scalable workflows all in one tool. SpiraTest is the best tool in terms of quality and value compared to the other competing programs available on the market. the time, productivity and cost savings are transparent.Benjamin-Michel GRIFFART, Technical Test Analyst, Oney Bank

Solutions For You, Whatever Your Focus

Mobile Banking

You need to provide world-class service to your customers, who expect on-demand, real-time banking in the palm of their hand. SpiraTeam not only enables you to deliver (and surpass) on this expectation, but also to maintain compliance with all banking regulations, processes, and financial controls.

Insurance

Ongoing changes in technology, demography, and consumer needs are disrupting the insurance industry.

Combined with increased regulatory and financial reporting demands, SpiraPlan helps you innovate while managing risk.

Financial Services

The technology landscape for finance firms is changing fast, with the rise of high-frequency trading, blockchain-based cryptocurrencies, increased privacy oversight, and AI-based forecasting. Our tools help you accelerate innovation and deployment while keeping user privacy and security as the top priority.

Features for Financial Services

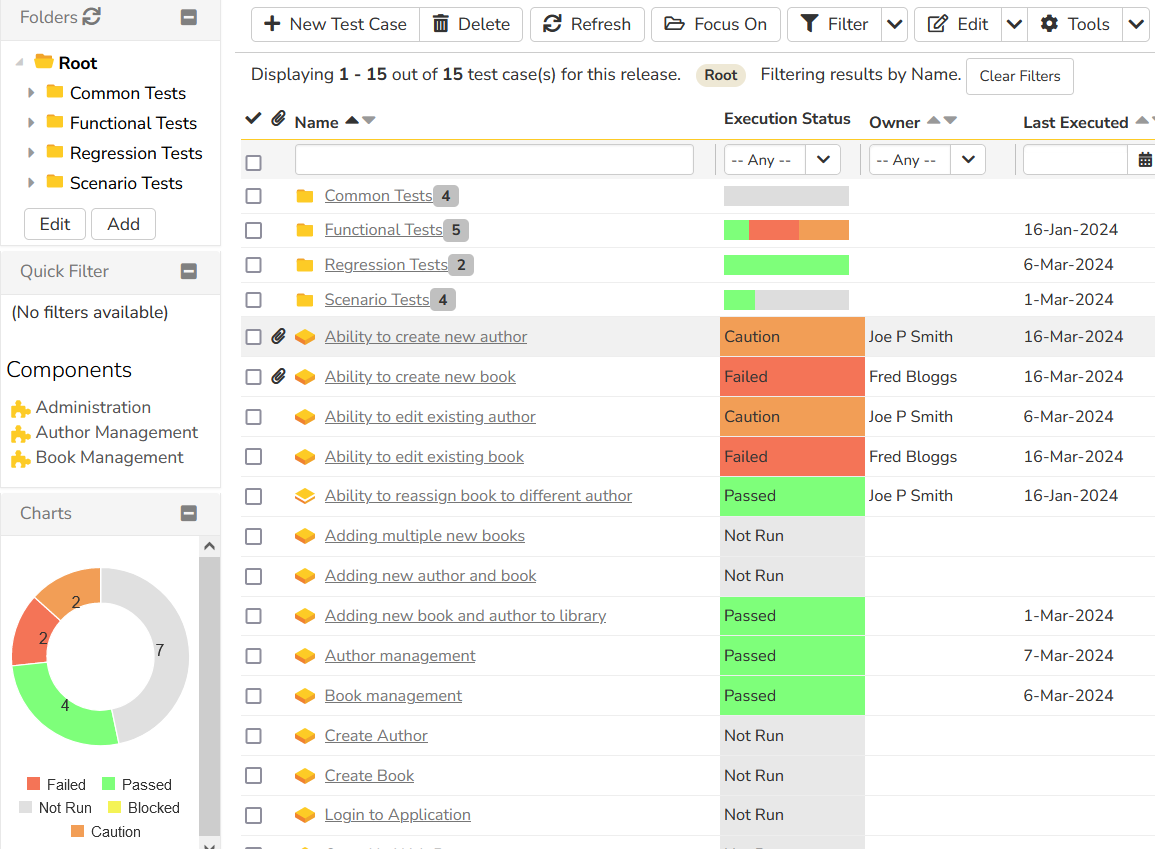

Requirements Management

Using SpiraTeam's integrated requirements management capabilities allows you to oversee and test all of your requirements, policies and regulations in a unified central hub.

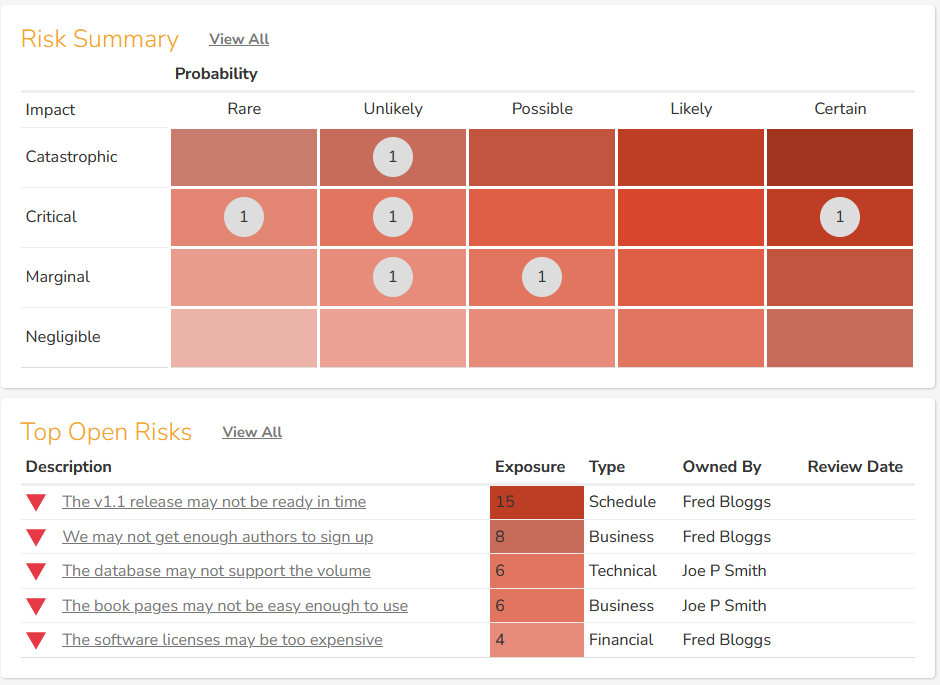

Manage & Mitigate Risk

With SpiraPlan, you have integrated enterprise risk management capabilities that let you manage risks across programs, projects and portfolios.

Security & Privacy

All of our products provide powerful security and privacy tools to ensure your data is secure, whether you choose to deploy on-premise on in our secure cloud.

Traceability & Compliance

Our platform gives you end-to-end traceability from the requirements, to test cases, defects, development work items, source code and resources.

Audits & Reporting

Our platform automatically maintains a secure audit-log of all actions in the system, with powerful reports on all activities for regulators and management.

Automated QA Testing

Save time testing your systems for compliance and quality. Our platform includes automation tools that generate test scenarios and scripts directly from your running applications.

Trusted By Industry Leaders

Featured Resources

Take A Deeper Dive

Webinars

Other Resources

- Understanding and Implementing KYC Guidelines

- Banking & Financial Software Development & Testing Challenges

- ISO 20022 Implementation for FinTech Payment Services

- DORA Compliance Checklist for Software Development

- Generali Insurance Case Study

- Oney Bank Case Study

- Presentation on Software Development & Testing Challenges in Banking & Finance

Try Inflectra For Free Today

Easy To Migrate

It's incredibly easy and user-friendly to switch to our platform. You can migrate your legacy data, documents, spreadsheets, and other critical information from other tools using our out-of-the-box migration features.

Free Trials

We encourage you to try our products in your environment. That's why we offer a 30-day free trial (no credit card needed), with all the functionality and our legendary technical support included.

Exceptional Service

Our products come with industry best practices baked in. They have over 70 out of the box integrations, default workflows and industry templates. All products include unlimited world-class technical support.